24+ heloc mortgage strategy

Learn More to Start Today. Web A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards.

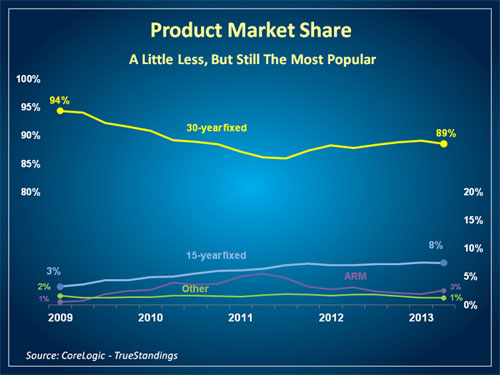

How To Pay Off Your 30 Year Mortgage In A Fraction Of The Time

Ad Put Your Home Equity To Work Pay For Big Expenses.

. If you have a 300000 mortgage with a 30-year payment term and a fixed 3 interest rate youve agreed to pay your lender 1265. These can include making home improvements paying off high-interest credit card bills and even settling medical bills. Web HELOC requirements are based on your monthly income and debts credit score employment history and home equity.

A home equity line of credit may be your best option for borrowing a large sum of cash which can be useful for costly home improvement projects. Todays 10 Best HELOC Mortgage Rates. A debt-to-income ratio thats 40 or less.

Get More Out Of Your Home Equity Line Of Credit. Web A home equity line of credit HELOC is a loan secured by the equity in the borrowers home. Skip The Bank Save.

Unlike a home equity loan which provides a lump sum a HELOC. Get More Out Of Your Home Equity Line Of Credit. It gives you access to a large sum of cash.

Top Lenders Reviewed By Industry Experts. Refinance Your Home Get Cash Out. However using a HELOC to pay off a mortgage is usually not a good ideaand well explain why.

Ad Compare Get Approved for the Best HELOC Loan that Suits Your Needs with the Lowest Rates. Web Say your home is worth 400000 with a remaining balance of 200000 on your first mortgage and your lender is allowing you to access up to 80 of your homes equity. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Lock In Your Rate Today. You cant draw any more on a fixed second mortgage the balance will only go down as. Web A HELOC taps into the equity in your home to provide money for various uses.

The Best Home Equity Loan Rates. Web HELOC lenders will usually lend up to 90 percent of your homes value minus the amount that you owe on your mortgage. To find a great rate on a home refinance use Credible.

For example if you have a 250000 loan with a 100000 balance 90 percent of your homes value would be 200000. Web HELOCs are flexible and can be used for anything you need the cash for including medical bills college tuition or other costs. Web Intro Early Mortgage Payoff Calculator HELOC Strategy The Kwak Brothers 311K subscribers Subscribe 466 Share 11K views 3 years ago Velocity Banking.

Learn More to Start Today. Learn About The Benefit of Cash Out Refinancing. Web HELOC strategy 3.

Skip The Bank Save. Qualification requirements vary by lender but. Web Using a HELOC to pay off your mortgage is essentially a form of refinancing.

Web The monthly home equity loan payment is about 1483 and you would pay about 6954 in interest over the loan term. In this example the home equity loan helps you save 44 on your monthly payment and 1842 in overall interest. Web Now lets look at using a First Lien HELOC and the strategy used to reduce your interest cost.

Special Offers Just a Click Away. Web An advanced strategy is to put your income into your HELOC and utilize your HELOC as your checking account. A HELOC often has a lower interest rate than some other common types of loans and the interest.

Web To give you an idea of what you might pay in interest the 52-week high on a 10-year HELOC is 609 while the 52-week low is 255 as of August 24 2022. Web Step 1. It allows you to reduce your interest rate without the closing costs associated with a home refinance.

Web Consider refinancing your HELOC into a fixed-rate second mortgage. Find The Lender Who Is Right For You. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Web The easiest way to consolidate your mortgage and home equity debt is to do a cash-out refinance of your primary mortgage and use the extra funds to pay off the. Why Not Borrow from Yourself. Subtract the balance on your mortgage and you have 100000 available to borrow.

Web HELOC requirements Lender requirements will vary but heres what youll generally need to get a HELOC. Using our previous example of a 200000 loan at the same interest. Take out a mortgage.

Apply Get Fast Pre Approval. We Do The Work So you Dont Have To. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Before you begin evaluate how stable your. Using a HELOC to pay off a mortgage Another HELOC strategy is to direct your HELOC cash toward your existing mortgage loan.

Ad Rates Are On The Rise.

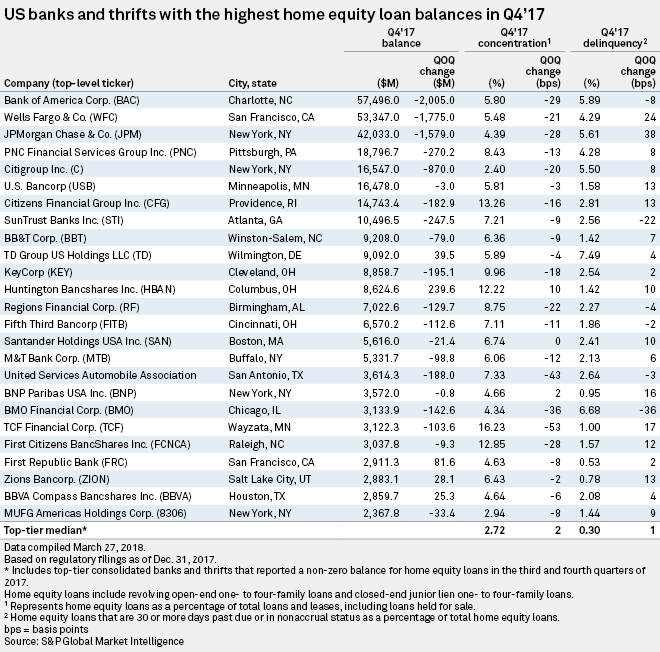

As Mortgage Rates Rise Helocs Gain Momentum S P Global Market Intelligence

Mortgage Loans Vs Home Equity Loans What You Need To Know

Hacking Your Debt With A Heloc Simple Passive Cashflow

Using A Heloc To Pay Off Your Mortgage

Heloc Strategy Is It Still Worth It Serious Update Youtube

Mary Diaz Marygdiaz Twitter

How To Use A Heloc To Pay Off Your Mortgage In 5 7 Years Or Earlier Youtube

Can A Heloc Strategy Really Help You Pay Off Your Mortgage Early Reviewscredit

Williston Park 2022 01 21 By The Island 360 Issuu

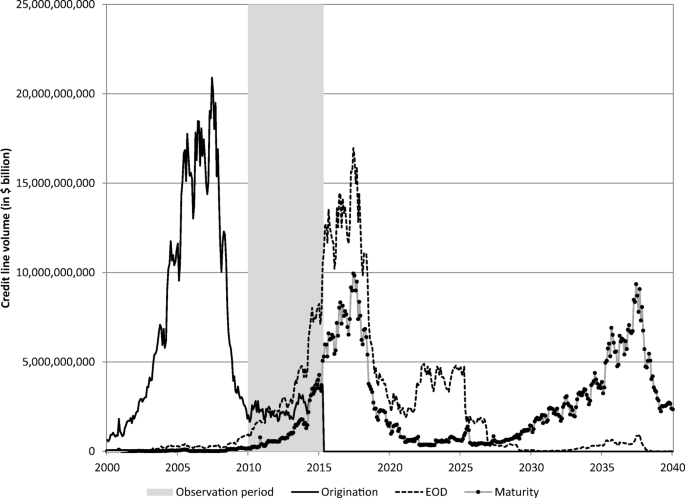

Positive Payment Shocks Liquidity And Refinance Constraints And Default Risk Of Home Equity Lines Of Credit At End Of Draw Springerlink

Heloc To Pay Off Your Mortgage Not The Best Strategy

C47496x7x1 Jpg

Jpmorganchase2018id

How Does Heloc Repayment Work Heloc Payment Guide

Heloc Secret To 0 Interest To Pay Off Mortgage Youtube

How To Use A Heloc To Pay Off Your Mortgage Smartasset

Second Mortgages Explained The 80 20 Piggyback And More